estate tax changes proposed 2021

So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms. Jul 7 2021 estate planning.

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax

82 School Street Piscataway Township NJ 08854 MLS 2301067R is a Single Family property with 2 bedrooms and 2 full bathrooms.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. Estates may carry more in taxes under proposed tax change. Estate Planning in Divorce. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to.

82 School Street is currently listed for. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40. Estate and gift tax exemption.

Advanced Topics QPRTs FLPs GRATs Dynasty Trusts and More. Plan for and administer retirement accounts in a trust or estate. The first is the federal estate tax exemption.

The current 2021 gift and estate tax exemption is 117 million for each US. California Specialization Credit in Estate Planning Trust. 234 million for married couples at a top rate of 40.

Since 2018 estates are only taxed once they exceed 117 million for individuals. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. For example a 20 million estate with have an estate tax.

Taxes are due the first day of February May August and November. One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in excess of. On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the.

July 13 2021. New Proposed Tax Law May Dramatically Affect Massachusetts Estate Tax Planning Part 1. We grant 10 days grace before interest is.

PROPERTY TAX DUE DATES. The Biden Administration has proposed significant changes to the. Inflation in 1000 increments and will rise to 15000 in 2018 and remain at.

On Behalf of Bradley Devitt Haas Watkins PC. It will take effect on October 1 2020. HOW TO PAY PROPERTY TAXES.

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Administration has proposed to tax capital gains when transferred by gift or at death. 2021 Tax Rate 3737 2021 Sewer Tax Rate.

The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday September 13 2021. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Lowering the Federal Gift and Estate Tax Threshold July 14 2021 By Family.

New Jerseys legislature will vote on the proposed tax hike before the September 30 2020 deadline for the 2021 fiscal year budget. Families who own homes and farms. In Person - The Tax Collectors.

2022 Updates To Estate And Gift Taxes Burner Law Group

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

What Is Estate Tax And Inheritance Tax In Canada

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

The Treasury Green Book Of Biden Proposed Tax Changes In 2021 Capital Gain Estate Tax Corporate Tax Rate

Massachusetts Estate Tax Everything You Need To Know Smartasset

5 Ways The Rich Can Avoid The Estate Tax Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

How Does The Deduction For State And Local Taxes Work Tax Policy Center

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

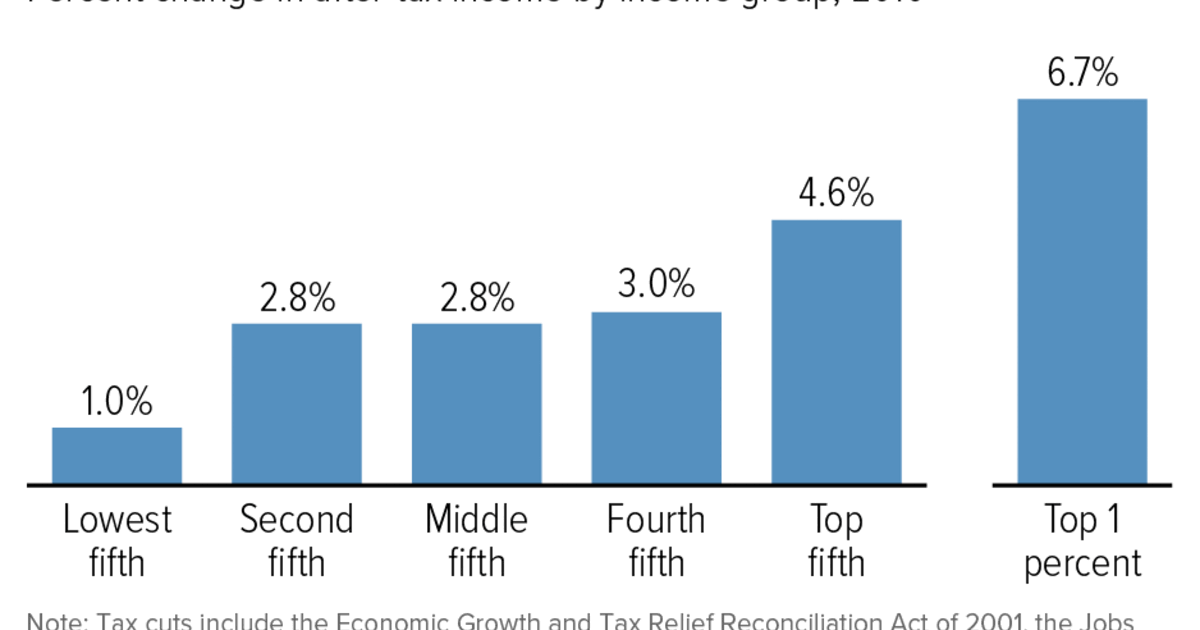

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation